- Home

- Views On News

- Dec 7, 2023 - The Big Bitcoin Rally. Why it Could be the Start of Something New

The Big Bitcoin Rally. Why it Could be the Start of Something New

US based Fidelity Investments is a big name in the industry.

You might have come across Fidelity owing to Peter Lynch, as he was known for managing the Fidelity Magellan Fund, a mutual fund division of Fidelity Investments.

According to its website, Fidelity manages over US$ 11.5 trillion (tn) in assets. Safe to say that they're one of the titans of the financial system and whenever they share an opinion publicly, investors all around are all ears.

In early November 2023, the institution's director of global macro segment, Jurrien Timmer shared an interesting take on Bitcoin.

To put things into context, he's been tracking bitcoin's rise for the past couple of years. He's actively engaged in periodic updates about bitcoin on his Twitter account.

The chart that he shared on Twitter recently was followed by some lines that caught my attention...

- In my view, Bitcoin is a commodity currency that aspires to be a store of value and a hedge against monetary debasement. I think of it as exponential gold.

Now that Fidelity is publicly calling bitcoin "exponential gold," Wall Street is also waking up to this same idea.

That brings us to Bitcoin's big rally.

Ever since the Bitcoin ETF approval news was out, the largest cryptocurrency has shot up big time.

After hovering in a range between US$ 20,000-25,000, in late October, Bitcoin's price went up to US$ 30,000 and broke that resistance.

This came as a surprise to many as the prevailing sentiment surrounding Bitcoin was still full of scepticism.

Whenever people heard 'bitcoin' or 'crypto', the first thing that they thought about was the FTX scandal and the big cleanup in the crypto industry post that.

But the holders kept faith and believed in the long-term story.

At the time of writing this, Bitcoin's price has shot up to US$ 44,000!

The crypto's price has been inching towards new yearly highs more frequently these days. It broke through US$ 40,000 last weekend for the first time since April 2022.

Let's look at some possible reasons behind this big rally.

Bitcoin ETF Approval

The primary reason we think Bitcoin is shooting up is because of a possibility of a Bitcoin spot ETF getting an approval soon.

In the past one month, there have been several media reports stating that the approval of a Bitcoin spot ETF is now in advanced talks.

So of course, as the general sentiment suggests, investors would like to get ahead of the news and enjoy gains when it actually does get approved.

The optimism started when bitcoin ETF issuers met with the US Securities and Exchange Commission and received feedback on their ETF applications.

Media reports now suggest that the ETF will be greenlit as soon as early 2024.

Talks about Bitcoin's ETF have been going on for years, since 2019 if memory serves me correct. The SEC has constantly delayed their decision on a Bitcoin ETF.

So, you could imagine the impact it will have now if it finally approves the ETF.

The approval of a Bitcoin ETF would generally mean large capital inflows, which could potentially lead to a massive price increase in the digital currency.

Since this is a consensus across the industry, it is an interesting exercise to think through the possible scenarios.

How are we thinking about this? Well, there are lots of possibilities when it comes to the current ETF approval, and we have more questions than answers.

But the one thing we noted is that regulators were in no rush to make a decision, which is probably a good thing.

Bitcoin is still a 'no-go' for many investors and the regulator is making sure of all the facts and possibilities before getting comfortable with the market dynamics of Bitcoin.

Investors Tend to Stay Invested for the Long Term

The other reason why bitcoin is moving up is because of lack of supply.

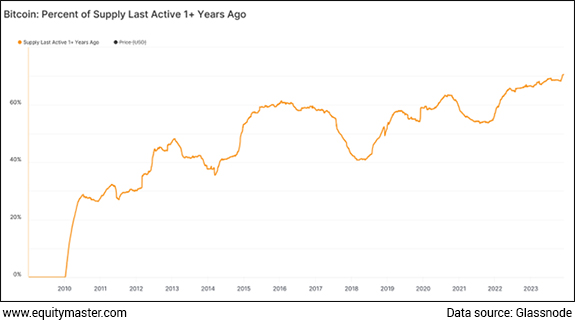

According to data from Glassnode, the supply of freely circulating bitcoin recently hit a historic low.

The amount of bitcoin in circulation that hasn't moved in 1+ year hit a new all-time high of around 70.5%.

See this chart which might give you a fair idea.

Despite the price being up more than 150% in the past one year, bitcoin holders don't appear to have any interest in selling.

Upcoming Halving

Another major event that significantly increases volatility in Bitcoin's price is the Halving event.

The crypto industry's prices really get unpredictable around the time of Bitcoin halving event, which happens roughly every four years and involves a halving of the amount of new Bitcoin that is issued to miners on the network.

Bitcoin halving is expected to take place in April 2024. The exact date is not yet known.

The bitcoin halving basically creates a supply shock, and demand-supply dynamics come into play.

Going by historical data, Bitcoin's price starts getting some momentum ahead of the halving as general economics suggest that a scarcity of something can help push up the price of a particular thing.

Data from CNBC shows that before the last halving in May 2020, the price of bitcoin increased by 19% in the preceding 12 months.

During the halving before that which took place in 2016, bitcoin rallied 142% compared with the 12 months prior price.

What Next?

From the above data points, one thing becomes clear. With over 70% of all bitcoin supply sitting dormant for a year, the momentum is surely building up.

It's simple economics... as new demand enters the market, the price could go up.

Satoshi Nakamoto once said, "When someone tries to buy all the world's supply of a scarce asset, the more they buy the higher the price goes."

Things could get really interesting over the next 12 months once there's clarity on ETF approval and as halving takes place.

Whether you like bitcoin or hate it, it's important that you spend some time to re-evaluate what is happening here.

It's not for any reason that Bitcoin is one of the best performing asset over the last decade despite all the chaos and uncertainty surrounding it.

Equitymaster on Cryptos

We at Equitymaster are not against investing in Bitcoins at all.

However, an investment like a Bitcoin should not be where you park your maximum savings. They should be the high risk-high return part of your overall corpus.

Equitymaster's take on cryptos is simple.

We don't get cryptos. It's something that has caught our imagination, but we just can't figure out a way to value it. Fundamentally speaking.

Our "fundamental" take on cryptos is in line with the approach anyone should have when dabbling in a space one does not understand.

Invest only what you can afford to lose. Nothing more.

Happy Investing.

Safe Stocks to Ride India's Lithium Megatrend

Lithium is the new oil. It is the key component of electric batteries.

There is a huge demand for electric batteries coming from the EV industry, large data centres, telecom companies, railways, power grid companies, and many other places.

So, in the coming years and decades, we could possibly see a sharp rally in the stocks of electric battery making companies.

If you're an investor, then you simply cannot ignore this opportunity.

Details of our SEBI Research Analyst registration are mentioned on our website - www.equitymaster.comDisclaimer: This article is for information purposes only. It is not a stock recommendation and should not be treated as such. Learn more about our recommendation services here...

Yash Vora is a financial writer with the Microcap Millionaires team at Equitymaster. He has followed the stock markets right from his early college days. So, Yash has a keen eye for the big market movers. His clear and crisp writeups offer sharp insights on market moving stocks, fund flows, economic data and IPOs. When not looking at stocks, Yash loves a game of table tennis or chess.

Equitymaster requests your view! Post a comment on "The Big Bitcoin Rally. Why it Could be the Start of Something New". Click here!

Comments are moderated by Equitymaster, in accordance with the Terms of Use, and may not appear

on this article until they have been reviewed and deemed appropriate for posting.

In the meantime, you may want to share this article with your friends!